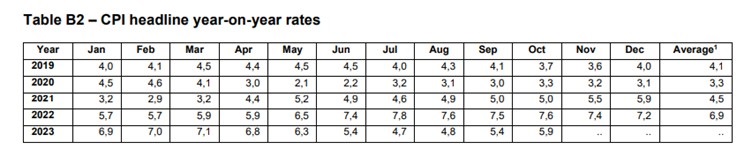

- Annual consumer price inflation shot up unexpectedly to 5.9% in October from 5.4% in September, according to data from Statistics SA.

- The higher-than-expected inflation figure might create some angst for Thursday's interest rate decision.

- However, Reserve Bank Governor Lesetja Kganyago is known to be cautious and warned at the last Monetary Policy Committee (MPC) meeting that food prices might drive inflation higher and was sombre in his tone about what that may mean for interest rates.

- For more financial news, go to the News24 Business front page.

The consensus view is that the Monetary Policy Committee (MPC) will keep interest rates unchanged at 8.25% on Thursday afternoon, but there is a chance of a hike after inflation threatened to break the upper boundary of the SA Reserve Bank’ targeted 3% to 6%, according to economists.

Annual consumer price inflation shot up unexpectedly to 5.9% in October from 5.4% in September, according to data from Statistics SA, but "the effect should be temporary, and core inflation is much better behaved at 4.4% y/y," said Razia Khan, managing director and chief economist for Africa and the Middle East for Standard Chartered Bank.

Khan said:

The rand weakened against the dollar after CPI numbers were released. The petrol price was the main culprit behind the inflation increase, and for consumers it was clear October was a particularly hard month with milk, cheese and eggs’ annual inflation at 12.4% and the cost of vegetables soaring 23.6% from a year ago.

The Organization of the Petroleum Exporting Countries (OPEC) and allied producers may consider additional oil supply cuts when it meets on Sunday, but the global oil market will see a slight supply surplus in 2024, Reuters reported. There’s also a temporary ceasefire between Israel and Hamas, which may, if it holds, help keep fuel prices steady.

The higher-than-expected inflation figure might create some angst for the interest rate decision, Shaun Murison, senior market analyst at IG, said in a note, "...but fuel prices in November are substantially lower and the rand has been trading well off its worst levels, which might aid the Quarterly Projection Model and see rates maintained at current levels."

Nonetheless, Reserve Bank Governor Lesetja Kganyago is known to be cautious and warned at the last MPC meeting that food prices might drive inflation higher and was sombre in his tone about what that may mean for interest rates.

There is still a slight chance that the SARB will raise by another 25 basis points, although this is not our base case, Murison said.

He added that the US Federal Reserve was unlikely to hike rates again this year and global policy appeared to be around the top of the cycle, with the local Reserve Bank likely to follow suit.

A drop in fuel prices in SA in December should result in lower food inflation just ahead of the festive season and give some comfort to motorists travelling longer distances during the holidays. Further, the unemployment rate dropped by 0.7 of a percentage point to 31.9% in the third quarter of 2023, compared with the previous three months, Stats SA data showed earlier in November.

That said, the cost of the average household food basket had already advanced 10.6% to R5 297.58 by October, according to the Pietermaritzburg Economic Justice & Dignity Group’s most recent research. That outstrips the R4 473.92 that a general worker being paid the national minimum wage earns in a month. But with the Reserve Bank’s mandate firmly set to target inflation, which diminishes the value of the money in the hands of SA’s poorest people, the financial hardship facing more than half of the country’s citizens is not its primary concern.

Johann Els, Old Mutual’s chief economist, said he expects the Reserve Bank will highlight its concerns about inflation risks, but will keep interest rates on hold.

With limited budgets, consumers spending more on petrol have less to spend elsewhere, potentially limiting price increases in other inflation categories, he said, adding that the marked easing of core inflation over the year and the rise of the real policy rate will make it challenging for the Reserve Bank to justify a rate hike. But Els anticipates a split decision from the MPC, with one or two members possibly voting for an increase.

Kganyago is broadly seen as a hawk, which means he tends to favour increasing interest rates in order to dampen inflation that’s trending higher than the Reserve Bank’s target. If there is a split decision, the governor may be one of the people voting for a hike, while Deputy Governor Kuben Naidoo, who has asked to resign before his term comes to an end and is awaiting an announcement from President Cyril Ramaphosa on the matter, is thought of as more of a dove and may vote to keep rates on hold.

READ | EXPLAINER | Kuben Naidoo's Reserve Bank resignation, why it matters and what happens next

The risk of another 25 basis points increase in both SA and US interest rates does remain, Annabel Bishop, Investec’s chief economist, said in a note, but found it unlikely, saying she doesn’t expect a hike "particularly given the recent appreciation in the rand. However, the SA Reserve Bank will likely evince a hawkish tone overall".

Khan agreed and said that even after the inflation upset on Wednesday, Standard Chartered thinks there's no chance of a late-cycle hike, with the impact of earlier tightening still feeding through.

The MPC is due to announce its last interest rate decision for the year at 15:00 on Thursday, while the next US Fed announcement is scheduled for 13 December, which is the same date that Stats SA is scheduled to publish its November annual consumer price inflation data.

Publications

Publications

Partners

Partners