The dollar rallied on Friday, after data showed US consumer prices accelerated in May, suggesting the Federal Reserve may have to continue with interest rate hikes through September to combat inflation.

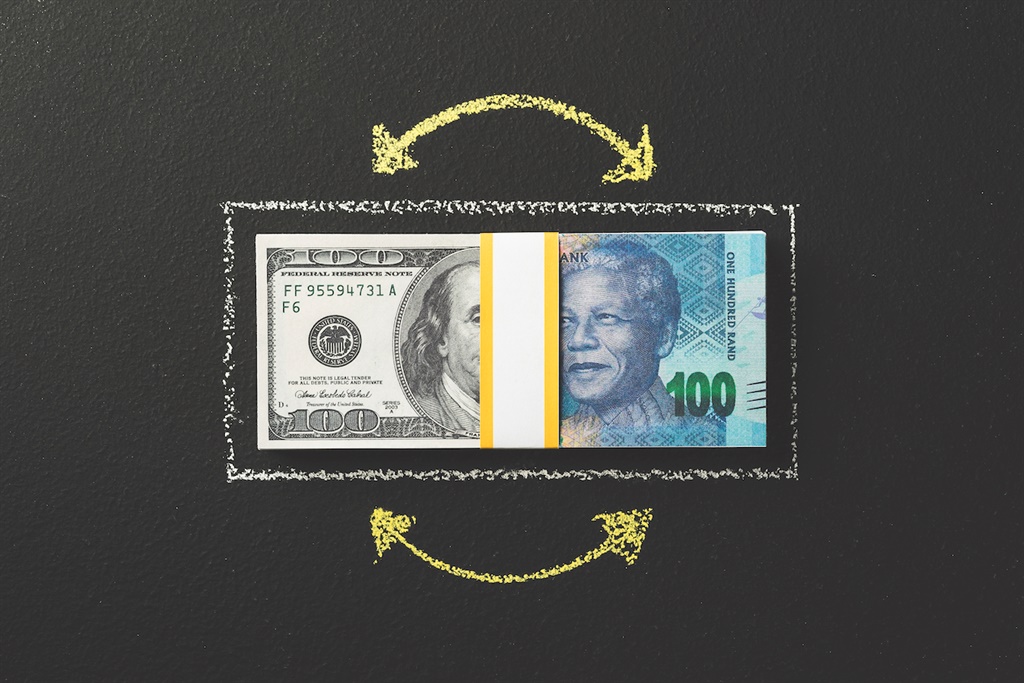

By late afternoon, the rand was down 2.7% against the US currency, trading at R15.83. On Thursday, the rand nearly touched R15.18 to the dollar.

In the 12 months through May, US CPI increased 8.6% after rising 8.3% in April. Economists had hoped that the annual CPI rate peaked in April.

The inflation report was published ahead of an anticipated second 50 basis points rate hike from the Fed next Wednesday. The U.S. central bank is expected to raise its policy interest rate by an additional half a percentage point in July. It has hiked the overnight rate by 75 basis points since March.

"Inflation is now at a 40-year high with little evidence that it has peaked," said John Doyle, vice president of dealing and trading at Monex USA.

"Stocks are extending losses on the expectation the Fed could find the scope to speed up rate hikes. The greenback is gaining on policy divergence and risk-off trading," Doyle said.

The US Dollar Currency Index, which tracks the greenback against six other major currencies, was 0.7% higher at 104.02, its highest since May 17, and within sight of 105.01, the two-decade high touched in mid-May.

The dollar's gains were broad based with the safe-haven Japanese yen the one major exception.

The yen, which has weakened this year on traders' bets that the BOJ will stick with its ultra-accommodative policy stance, was about 0.11% higher against the greenback after the Japanese government and the central bank, in a rare joint statement, expressed concern about its slide to hit two-decade lows. The dollar was last at 134.18 yen.

After a meeting with his Bank of Japan (BOJ) counterpart, the country's top currency diplomat Masato Kanda told reporters that Tokyo will take appropriate action as needed, a sign Japan may be edging closer to intervening in the market in a bid to arrest the yen's declines.

The dollar was up 0.81% against the Swiss franc at 0.9883 francs after the U.S. Treasury Department on Friday said Switzerland continued to exceed its thresholds for possible currency manipulation under a 2015 U.S. trade law, but refrained from branding it a currency manipulator.

With the U.S. inflation data knocking investors' risk appetite, the risk-sensitive Australian dollar reversed direction to trade down 0.43% on the day.

Sterling fell 1.0% to $1.2375 and was set for a second consecutive week of declines as Britain's gloomy economic outlook left investors on edge.

In cryptocurrencies, bitcoin slipped 2.4% to $29 382.74, as the world's largest digital currency by market value continued to struggle to overcome a bout of selling pressure that has taken it below the $30 000 level in recent sessions.

- Additional reporting by Fin24

Publications

Publications

Partners

Partners