- SARS collected R52 billion more in tax over the past year than in the previous year - despite a sharp slump in corporate tax.

- In just four days in March, it collected more than the entire tax take of 1995.

- The amount of money earned from clampdowns on tax fraud and underpayment surged by more than a quarter.

- For more financial news, go to the News24 Business front page.

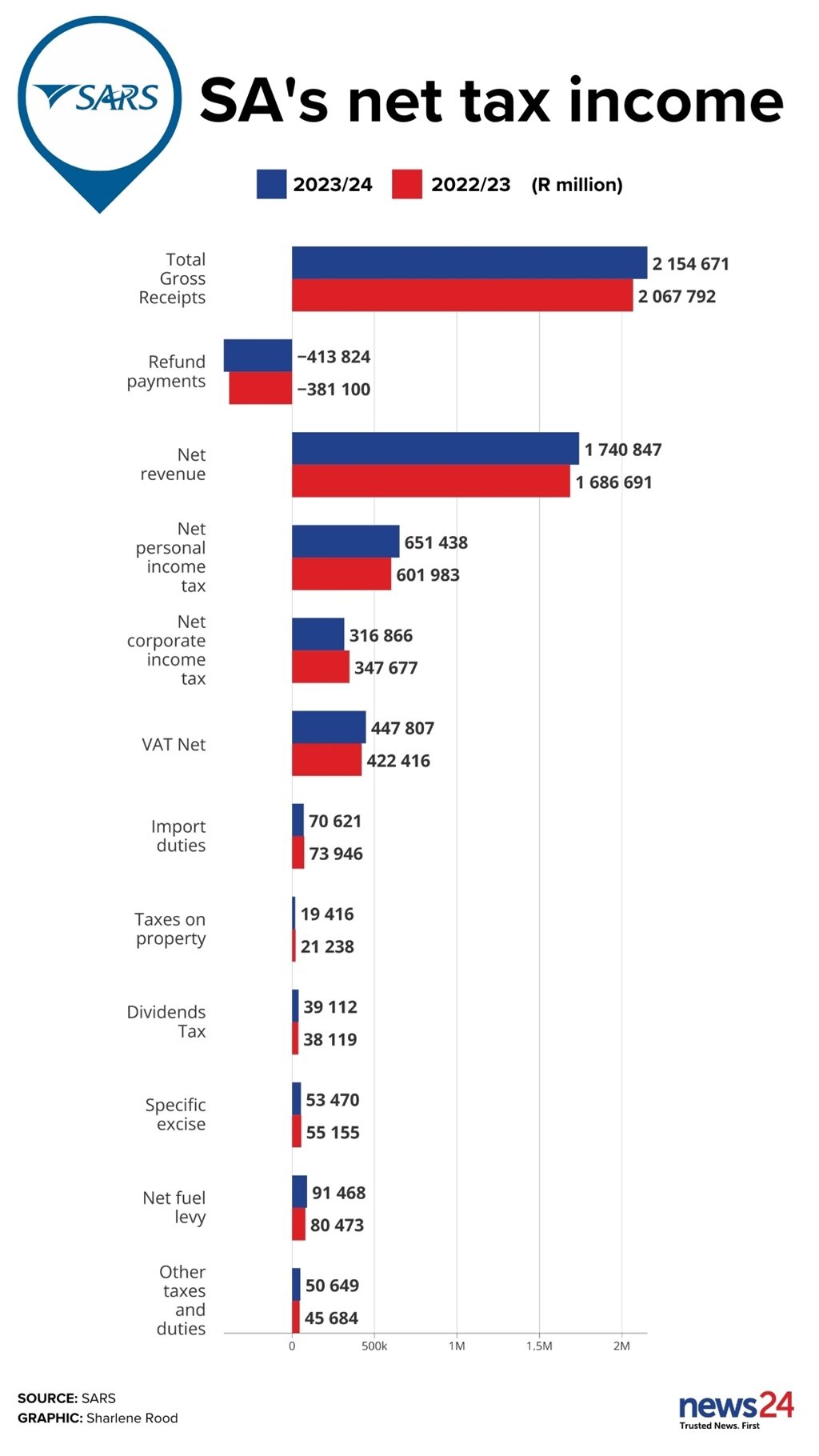

For the fiscal year to end-March, the South African Revenue Service (SARS) collected gross tax of R2.155 trillion – a new record and R10 billion more than Treasury's last estimate in February.

In just four days in March, SARS collected the equivalent (R114 billion) of the total tax amount collected in 1995 for the entire year. Tax collections have grown by almost 10% per year since 1997.

The 2023/24 tax take was R52 billion more than the previous year, thanks to growth of more than 8% in VAT (a total net amount of R448 billion) and personal income tax (R651 billion). The latter benefitted from average salary hikes of 6.3% and large bonuses in the financial sector.

In contrast, corporate income tax declined by almost 9% to R317 billion – with tax from the mining sector shrinking by R42 billion as commodity prices slumped.

VAT refunds grew by almost 9% to R414 billion, equal to 6% of SA's GDP. But R101 billion of "impermissible" refunds were stopped by SARS.

"Whilst we are pleased that the R414 billion returned into the hands of taxpayers is good for the economy, I remain concerned about the refund fraud and abuse," says SARS Commissioner Edward Kieswetter.

Clampdowns on fraud and "wilful noncompliance" as part of its compliance programme netted SARS almost R294 billion, 27% more than in the previous year. This included:

- R3.5 billion from more than 1 400 voluntary disclosures;

- R19 billion from 28 000 individuals who paid too little provisional tax;

- R20 billion from syndicate crime investigations, including from a single large illicit tobacco and gold scheme; and

- R6.6 billion from 6 550 customs seizures.

SARS now uses artificial intelligence and machine learning algorithms to unearth criminality and noncompliance.

SARS achieved an 84% victory rate in 110 court judgments in tax cases over the past year. Some 85 criminal investigations were handed to the National Prosecuting Authority, which resulted in a 95% conviction rate and total prison terms of 49 years.

Some 1.1 million new individuals were registered with SARS over the past year, bringing the total number of individuals and trusts to 28 million. Almost 40 000 new employers were registered for PAYE, with 650 000 employers now on the tax register.

Publications

Publications

Partners

Partners