The Financial Intelligence Centre Act (FICA) has been amended to include many more businesses under the scope of so-called "accountable institutions". This means these businesses must comply with laws aimed at curbing illegal activity or face the risk of massive penalties. Tracy-Lee Janse van Rensburg explains the changes.

- For more financial news, go to the News24 Business front page.

With effect from 19 December 2022, the list of "accountable institutions", as contained in Schedule 1 to the Financial Intelligence Centre Act, 38 of 2001 (FICA), was amended and the scope of accountable institutions was substantially extended.

As a result, several businesses which were not previously considered accountable institutions for purposes of the FICA have now been brought within the realm of the legislation and must comply with the FICA as well as the duties imposed on accountable institutions.

Besides the amendments to Schedule 1 of the FICA, in terms of the General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Bill (GLA), several additional amendments were effected to the provisions of the FICA, which came into effect from 31 December 2022.

Set out below is a discussion of the most important consequences of these recent amendments.

The list of accountable institutions under the FICA has recently been extended to include, among others:

- a person who carries on the business of creating a trust arrangement for a client;

- a person who carries on the business of preparing for or carrying out transactions (including as trustee) related to the investment, control, safekeeping or administering of trust property within the meaning of the Trust Property Control Act;

- a cooperative bank as defined in the Cooperative Banks Act, 40 of 2007;

- a person who carries on the business of a credit provider as contemplated under the National Credit Act, 34 of 2005 (NCA);

- a person who carries on the business of providing credit in terms of any credit agreement which is excluded from the application of the NCA, pursuant to the provisions of sections 4(1)(a) or (b) of the NCA;

- a person who carries on the business of a money or value transfer provider;

- a person who carries on the business of dealing in high-value goods in respect of any transaction, where such business receives payment in any form to the value of R100 000 or more; and

- a person who carries on the business or operation, for or on behalf of a client, which would include exchanging one form of crypto-asset for another, concluding a transaction which transfers a crypto-asset from one crypto-asset address or account to another or the safe-keeping or administration of a crypto-asset or an instrument enabling control over a crypto-asset.

What must these entities now do?

Given the extended scope of the list of accountable institutions, it will be necessary for those entities to ensure that, going forward, they comply with the provisions of the FICA.

It will be necessary for them to:

- register with the Financial Intelligence Centre (FIC), no later than 19 March 2023. The registration on the FIC's go-AML system can be completed on the FIC's website;

- appoint a compliance officer, which must either be an employee or director of the accountable institution;

- prepare a risk management and compliance programme (RMCP), which will have to comply with the provisions of section 42 of the FICA. The RMCP will have to be signed off by senior management and/or the board of directors;

- undertake a risk-based assessment in relation to the identification and verification of clients with whom they conclude a transaction or enter into a business relationship with.

It will be necessary for accountable institutions to risk-rate clients and to undertake customer due diligence on clients based on their relevant risk assessment. They will also need to undertake ongoing customer due diligence in relation to those clients with whom they concluded a business relationship.

Moreover, they must retain records in relation to the transactions concluded with clients, in line with the provisions set out in the FICA.

Accountably institutions must also submit reports to the FIC in relation to, inter alia, any transactions above the prescribed cash threshold, any suspicious and unusual transactions or any electronic fund transfers above the prescribed threshold; and provide ongoing training in relation to the provisions of FICA and the obligations to be undertaken by accountable institutions.

Why compliance is important

One of the significant changes to the FICA is the expansion of the concept "beneficial owner", as well as the additional obligations which have been placed on accountable institutions in relation to the identification and verification of the beneficial owners behind juristics, partnerships and trusts respectively.

Additional obligations have been placed on accountable institutions to identify and verify the trustee, the founder as well as the beneficiaries under a trust.

The GLA has also extended the scope of FICA in relation to the identification of persons involved in money-laundering activities and offences related to the financing of terrorist and related activities to include offences relating to proliferation financing activities which contemplates the provision of financing to manufacture, develop, possess, transport, transfer or use nuclear, biological or chemical weapons.

Failure by an accountable institution to register with the FIC, to comply with their reporting obligations under the FICA, to establish, document and maintain an RMCP, to provide adequate training or to retain records, will result in noncompliance with the provisions of FICA and an accountable institution could be subject to the imposition of an administrative sanction by the FIC which includes, but is not limited to, a financial penalty not exceeding R10 million in respect of natural persons and R50 million in respect of legal persons.

In light of such consequences, it is imperative that accountable institutions ensure their compliance with the provisions of the FICA.

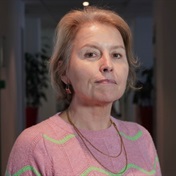

Tracy-Lee Janse van Rensburg, Banking & Finance Director at Werksmans Attorneys. News24 encourages freedom of speech and the expression of diverse views. The views of columnists published on News24 are therefore their own and do not necessarily represent the views of News24.

Publications

Publications

Partners

Partners