Cape Town – While Eskom is set on having a nuclear power station operational by 2025, the issue of financing a major infrastructure project has been top of mind.

Government has stated that nuclear will only proceed at a scale and pace it can afford, but Eskom has made it abundantly clear that it will get a nuclear power plant up and running by 2025. And that’s despite a new draft energy plan, which sees nuclear being delayed by decades.

For Eskom to have its way, construction will have to begin by 2021, and the procurement process needs to be completed pronto. “To have a nuclear reactor operating in 2025, you need a 10-year lead time, which will start now,” acting Eskom CEO Matshela Koko said at the launch of the draft Integrated Resource Plan in 2016.

Two major obstacles need to be overcome for this to occur. The first hurdle concerns Eskom’s R350bn worth of contingent liabilities or guarantees, which cannot be increased any further, according to National Treasury. The second issue concerns the funding of the new build programme, which could cost between R700bn and R1trn+.

Anthony Julies, National Treasury deputy director general and head of the asset and liability management division, told Fin24 in an interview last month that Eskom cannot receive any more guarantees at present for the current build programme. "If we gave Eskom any additional guarantees for a nuclear build programme in the next three years, it would be in breach of the fiscal (or expenditure) ceiling as announced in the 2017 Budget."

Reducing exposure to guarantees

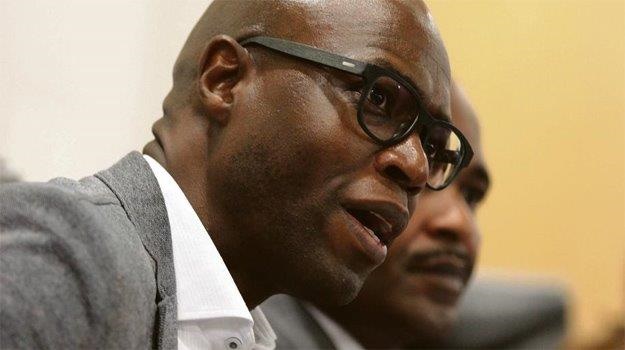

However, Democratic Alliance MP and shadow energy minister Gordon Mackay has revealed how Eskom can overcome these hurdles and burden consumers in the process.

Speaking to Fin24 in a studio interview recently, Mackay said Eskom could dramatically decrease its exposure to guarantees to overcome the first hurdle.

It could do this by halting the completion of its units at Kusile and Medupi, and then by moving the hefty Independent Power Producer (IPP) guarantees to Treasury. “The main focus will be to free up existing sovereign guarantees for Eskom and that is going to be mostly impacting Kusile and Medupi,” he said.

WATCH: Interview with Gordon Mackay

Calculating this scenario

Currently, Eskom’s 2016/17 guarantee is R350bn, while its exposure (the amount borrowed against its guarantee) increased to R218.2bn, according to Treasury’s Budget Review. Exposure to IPPs is expected to amount to R125.8bn.

Eskom’s spending plans at Medupi over the next three years are expected to be R35.8bn, while Kusile will cost R35.4bn, according to the Budget Review.

Therefore, if all these contingent liabilities were removed from Eskom’s books, it would have almost R200bn spare financial capacity.

This process might have even started, after Koko wrote to the signatories of the Government Support Framework Agreement regarding its obligation to buy electricity from renewable-energy IPPs, “to discuss a possible triggering of government support in light of current constraints to recouping the costs through the tariff and the Regulatory Clearing Account mechanism,” according to Engineering News on March 15.

Even if Treasury does not remove the IPPs from its books, Eskom could still gain R71.2bn in guarantees from Medupi and Kusile. That’s just about how much Eskom needs to build its first reactor.

Eskom chief nuclear officer David Nicholls told Chris Yelland recently that he expects the “overnight capital cost for the early machines in the range of $4 500 per kilowatt”. Rosatom, which is the front runner in the new build programme, produces the VVER-1200 PWR reactor, which produces 1 200 kilowatts. That would mean the first reactor would cost Eskom $5.4bn or R71.77bn.

Yes, it would be a catastrophe to cancel the completion of the already over-budget, over-time coal new build programme, but it might offer Eskom a spring to overcome this hurdle. “That would be a huge sunk cost, but what that would allow them to do is transfer those guarantees that are being used there into guarantees for new build programme,” Mackay said.

However, speaking to Julies in March, the deputy director general was very clear that the guarantees can't be used for anything but their stated purpose. "If that money is used for a different project, it will carry a different risk profile and would require an entirely new application for a guarantee approval. It will still be in breach of the fiscal framework announced in the 2017 Budget," said Julies.

WATCH: Interview with David Nicholls

Eskom’s thoughts on cancelling Kusile

Responding to a query by Fin24, Eskom said “cancelling part of Kusile theoretically only makes sense if the remaining cost to completion, per kilowatt of capacity, and the resultant levelised costs of electricity is greater than any viable alternative”.

“If 70% of a project cost has been spent, with the balance fully committed contractually, the cost of cancellation could well be similar to the cost of completion.

“By the time the surplus capacity is fully utilised, the cumulative premium between the cost of … renewables and Eskom’s average variable cost might well exceed R200bn – double the number mentioned by some analysts as potential benefit for 'cancelling the second half of Kusile'.

“No one is suggesting however that these PPAs (power purchase agreements) be cancelled or disallowed by the regulator as inefficient and not prudent. The same approach should be followed with Kusile.”

How Eskom could finance nuclear

Eskom’s other obstacle is the question of upfront costs to finance the new build project.

Mackay believes Eskom will enter a joint venture with the winning vendors, which he expects will be Rosatom.

“(Rosatom) will be responsible for providing the main component of the equity needed up front,” he said. “This will then result in Eskom having to sign what we call an off-take agreement or a power purchase agreement.

“It is here where Russia will make its money,” he said. “They will provide upfront capital, but then they will push for a very tough deal on the PPA so that it can extract significant value from the whole programme and make a good return on investment.

“That will then be passed on to South African consumers, via higher tariffs,” he said.

This, according to Mackay, is where consumers will pay the price for South Africa's ambitious nuclear plans.

While Nicholls said the levelised cost of electricity from nuclear must be between “R0.80 and R1.00 per kWh for the first two reactor units”, Mackay believes it will be above R1.30 per kWh.

“We are looking at a very high price of electricity here,” he said.

However, Nicholls told Fin24 on Wednesday that Eskom would not enter a joint venture and said Eskom wants a deal that will not impact too heavily on consumers.

“While (Eskom) sees the vendor as supplying a comprehensive financing package at attractive interest rates, (it) does not currently expect to require an equity position from the vendor,” he said.

“This may be affected by the financial offers made by the vendors, but as one of Eskom’s key objectives is to target an overall cost of between R0.80 and R1.00 per kWh from the early units of the nuclear build, we would only encourage equity from the vendor if it resulted in a lower tariff for the South African consumer.”

Treasury points to possible 'hypothetical' solution

In an interview with Fin24 days before Pravin Gordhan and Mcebisi Jonas were removed as minister and deputy minister of finance, Julies painted various theoretical scenarios regarding nuclear.

The Treasury deputy director general explained how the nuclear procurement build programme could theoretically begin according to Koko’s timeframes of having an operational plant by 2025.

Assuming that, for the next 10 years, Treasury is not in a position to accommodate any additional guarantee exposure, building a nuclear power station could theoretically start “tomorrow”, he explained.

"This can however only happen once the procurement and financing requirements have been concluded.

“Even then, if you finalised the financing and procurement approvals now, drawing down against any additional approved guarantees will only be done in a manner that the fiscus can accommodate and consistent with the stated policy objective of fiscal neutrality.

"Your actual exposure to that facility only arises once a draw down has occurred against an approved guarantee, which, in the scenario above, may only arise in 10 years' time. But the financing and procurement decisions can be taken as soon as all the required information is available.”

However, he said, Eskom could negotiate “a grace period of financing” with any potential financier if they want a power station operational in 2025.

“There will therefore be no financing now that exposes Treasury or exposes government in that period. In this scenario, government would now already be indicating that the only time we would have the appetite to increase its exposure would be two years hence, (i.e. in 2027).

“If the arrangement was that there would be no obligation on the fiscus and therefore some kind of grace period, until such time that government and the fiscal framework is comfortable to accommodate such an additional exposure, provided all PFMA (Public Finance Management Act) requirements are met, then those are the kind of negotiations within those agreed-to constraints that you would enter into.”

Read Fin24's top stories trending on Twitter: Fin24’s top stories

Publications

Publications

Partners

Partners