I get many questions from investors wanting to know where the rand will be by the end of 2020. Usually they also ask what is going to happen to the JSE and international stock markets.

It is impossible to predict the direction of any market and it is especially difficult to do this in a time of massive uncertainty and change. Making confident predictions that the rand will collapse or the JSE will implode would be a foolish thing to do. The truth is that no one knows.

However, we can try to understand what moves our markets and that will help us to determine the value of the JSE and the rand in the next few years.

Rmerging markets have had a bad time

I always find it interesting how some people explain the bad performance of the JSE as if it is an isolated island. They look for very simplistic explanations such as Zuma's terrible presidency, bad economic policies or labour market rigidity.

While all of these are real factors in the JSE's performance, they only tell part of the story. For example, Emerging Markets have had a torrid time over the last ten years. The MSCI Emerging Markets Index has lost money in dollars over the last five years and has only grown by 1.5% per year for the last 10 years. The experience of the average investor in the JSE would be worse but the trend is similar.

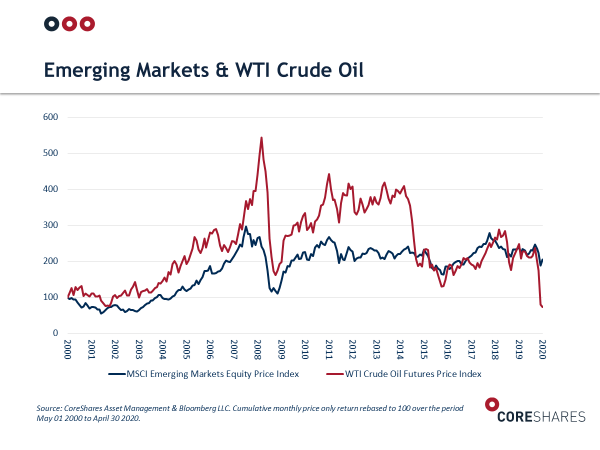

We need to understand what drives Emerging Markets as this will be a big factor in the performance of the JSE in future. The graph below was compiled by CoreShares and it shows the relationship between the price of Oil and the performance of Emerging Market (EM) shares.

My observation is that EM stock markets tend to rise strongly when the price of oil rises, and they also tend to fall sharply if oil prices collapse. It is also clear that Emerging Markets can rise without the oil price rising.

Given the recent rebound in oil, it is possible that a sustained recovery in oil will signal a sustained recovery in EM shares. I believe that if the oil price continues to recover in a sustained manner, it will drive the performance of the JSE as it is one of the most liquid EM for international investors. I also believe that shares in an Emerging Market will rise if the currency of that country strengthens. In summary, if we see a rising oil price on a sustained basis, we can assume that the Rand and the JSE will strengthen on a sustained basis.

It is important to note that global investors are not always particularly concerned with the dynamics of individual Emerging Markets. If they decide that the world is in a state of recovery, they tend to buy EM markets in proportion to their size. This is a critical point because it means that the sustained selling pressure that the JSE has experienced over the last decade might reverse.

I also think that the JSE has had to deal with the constant threat of a ratings downgrade that caused more international investors to sell shares rather than buy. As the downgrade has happened, it has cleared out this selling pressure and opened the doors to different investors who will benchmark SA against other "junk" countries. Naturally, investors will avoid the JSE if our economic policies remain unfavourable. Any material structural reforms are likely to increase the buying pressure on the JSE.

What happens in New York matters

One of the big factors that will improve global investors' appetite for risk is what happens in the US economy and their stock market.

I am worried that the US stock market is expensive after recovering from the sharp sell-off of February and March. If investors become skittish about Covid, a Cold War with China or the US economy, it is likely to cause the US markets to drop again and this will be negative for all Emerging Markets including the JSE.

This is not a reason to avoid EM shares as I believe there is great value in EM shares. If we see a slight recovery in the global economy and optimism about a Covid-19 vaccine, it will be positive for EM shares. I would be allocating a portion of my money to EM around the world. I remain cautious on the rand/dollar; I think the rand can easily recover to R17.00 and I would consider sending a portion of my money out whenever the rand is below R17.50 to the Dollar.

Don't make big moves

In summary, I think the opportunity for the next decade will be global Emerging Markets. That does not mean you should invest all your money in Emerging Markets now and expect a massive return in the next few months.

I think the world is going to be digesting the economic effects of Covid-19 for another 24 months. That means you can make gradual changes and realign your investments over time – big moves in volatile times are often a way to lose money.

As a final note, I would ignore the "futurists" who tell us about how the whole world is going to change after Covid-19. No one knows what will happen and human beings rarely change their behaviour in a radical way unless they are forced. Take time to watch the story unfold, it is going to take years, not weeks.

Warren Ingram is a Director of Galileo Capital and hosts the HonestMoney Podcast.

Publications

Publications

Partners

Partners