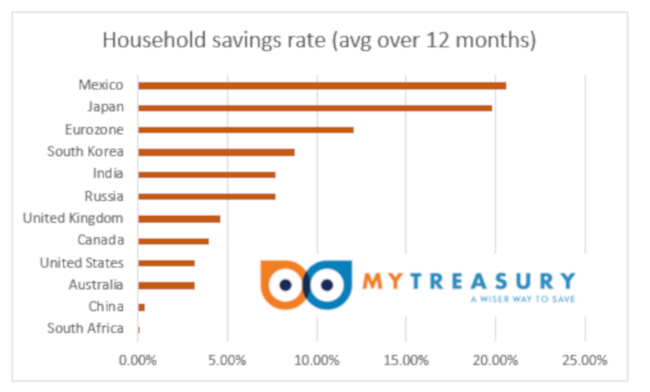

South African’s household savings rate comes last when ranked against the G20 countries, a recent survey has shown.

According to analysis by savings fintech startup MyTreasury.co.za, many South Africans are living in debt or eating into their capital.

"These finding are consistent with the worrying picture painted by Old Mutual Savings Monitor: among urban working households, an alarming 40% of respondents said they have no form of formal retirement savings at all. 32% of respondents said they would rely on government and 38% their children to support them in retirement," the company said in a statement.

"The situation is likely much worse among the not working population."

In addition, MyTreasury said, many of those South Africans who do manage to squirrel away some money are not saving wisely.

"While 16 million South Africans do have savings accounts, they are emptier than they should be, and according to the latest SA Reserve Bank statistics, about 40% of this money sits in accounts that offer very low interest rates, if any interest at all."

The company advised consumers to look for savings options that would allow them to earn as much as 10% on their money each year. "You could be growing your wealth faster just by switching to higher interest paying accounts."

MyTreasury.co.za is an independent personal finance comparison website that helps South Africans compare saving options online to ensure they get the highest interest, based on personal requirements.

Save efficiently

Warren Kopelowitz, CEO at MyTreasury, says efficient saving can make a big impact. "Efficient saving can make a massive difference to your wealth. Moving your cash from a call account that offers returns of 3% to a long term fixed deposit with an interest rate of 10% for example, would effectively double your wealth over ten years."

With so much to be gained from switching to higher interest rate deposits, why do so many South Africans continue to keep their money in low or no interest paying bank accounts?

"The savings market is opaque and complex, making it virtually impossible to identify the highest paying savings account that best matches your requirements," MyTreasury says.

"For instance, some banks offer higher rates for seniors but do a poor job of marketing this. It is difficult to find bank rate data, without comparing rates across multiple banks and products. Trying to find the best rate for your specific profile and savings preferences is even more convoluted and time-consuming."

"Savings accounts are a great way to encourage smarter wealth management.

"Just about everyone has a bank account, and by urging people to see their ordinary bank accounts as tools for actively generating income, we hope to make South Africans keener to save.

"It doesn’t cost you anything to get higher returns on your cash, but you need to know how to compare and where to look," says Kopelowitz.

Household savings: How SA stacks up

Knowledge is power

Dominique Collett, head of AlphaCode, a club for fintech startup entrepreneurs powered by Rand Merchant Investments, says often it is a lack of information, or misunderstanding the information they have, that leads consumers to make poor saving choices. "Consumers need the right information to make good financial decisions.

"The complexity of savings products and different interest rate structures and calculations makes it difficult for consumers to accurately compare, and is a major problem in growing SA’s savings culture.

"Being able to compare products so you can assess value is important in a competitive market."

* Sign up to Fin24's top news in your inbox: SUBSCRIBE TO FIN24 NEWSLETTER

Publications

Publications

Partners

Partners