The Fed will take it slow and easy rather than have a repeat of 2013’s ‘Taper Tantrum’.

When it comes to the world of money, put simply, we are all price takers. The US Federal Reserve (Fed), the custodian of the worlds reserve currency, is the ultimate price setter. It’s not surprising that markets, investors and even policy makers globally hang on to each word from Jerome Powell, the current Chair of the Fed.

Last week was no exception. The Federal Open Market Committee (FOMC), consisting of 12 members including Powell and an assortment of governors and regional Fed presidents, deliberated the course of the US economy, the path of US interest rates and in effect, the financial fate of the world.

The debate around whether US inflation (currently at 3.6%) is “transitory” continues. Last week’s meeting was a critical watershed in assessing whether accommodative policies remain in play or if the time to pare those back was rapidly approaching.

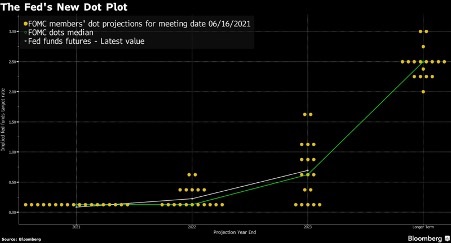

At this stage, it is important to introduce the Fed’s ‘Dot Plot’. The Dot Plot is an expression of how the 12 FOMC members and six regional Fed bank presidents’ view policy rates over the next three years and beyond.

Each dot represents an individual’s view for where they see policy rates at the end of each respective year. Given that four Fed seats are rotated annually, the Dot Plot is susceptible to changing opinions as well as changing members. In short, it is not infallible, but is regularly viewed by the market as a signal of intent.

I introduce the Dot Plot as it is largely responsible for the angst in markets last week. The most recent Dot Plot indicated that while many FOMC members remain dovish (lower rates for longer), that the dispersion in opinions is increasing.

This resulted in the average FOMC estimate for rates now projecting two hikes by the end of 2023, a remarkably hawkish (higher rates) outcome. The market reaction was immediate, with the US 10-year bond yield spiking 10 basis points (0.1 percentage point) on the release to around 1.6% (1.5% at the time of writing).

In remarks at the press conference following the FOMC, as well as later remarks to Congress earlier this week, Powell and other Fed members acknowledged the hawkish signal provided by the Dots and aimed to dial back the rhetoric, thereby calming markets.

Let’s step away from the short-term knee-jerk reactions and immediate narrative to properly digest what exactly is happening behind the scenes. The Fed is at pains to stress that it is not behind the inflation curve. It indicates that while supply-chain bottlenecks and labour market dynamics are causing some near-term pressure, that it still believes that inflation is transitory. ‘Jawboning’ is still alive and well as a policy tool.

Powell was also at pains to stress the high degree of uncertainty, stating that “no one knows with certainty where the economy will be a couple of years from now.” While such a statement may appear trite, it is the nub of the issue. Neither Dot Plots nor dialled back rhetoric are based on any distinct certainty.

The most pressing structural concern now remains the unintended consequence that stimulus cheques have had on the US labour market in possibly disincentivising work and thereby tightening labour supply. With commodity prices coming off the boil, lumber and other bottlenecks easing, labour market tightness will remain a key touchpoint to watch.

The FOMC will next meet in July before the summer holidays are in full swing. Thereafter, the annual Jackson Hole retreat in August will be the main event to watch for further signalling. It’s also important to note that the Fed’s current policy tools comprise not just of the Fed funds rate, but also asset purchases.

Currently, the Fed is buying $80bn worth of US treasuries and $40bn worth of mortgage-backed securities monthly as part of its stimulus program. Bear in mind that policy moves, especially tapering of massive stimulus measures, are a long game. If the Fed is concerned about inflation, the natural reaction function may well be to taper asset purchases first, before a ‘lift off’ on policy rates.

The Fed remembers the ‘Taper Tantrum’ of 2013. Slow and steady wins the game. Remember that from December 2013’s initial taper of asset purchases, that rates only began to rise in Dec 2015. Powell’s term also comes to an end in February next year introducing another level of uncertainty.

For now, there are a lot of moving parts. It is important to note that the Dot Plot has been prone to overestimation in the past. Since I began following the Dot Plot over 10 years ago, I have observed how they overshoot, only to pull back in line with market realities. The Fed itself has indicated that the Dot Plot is not a decision or a plan. Considering this, perhaps we shouldn’t panic just yet that the Fed has lost the (Dot) Plot.Mohammed Nalla, CFA is the founder of Moe-knows.com.

Publications

Publications

Partners

Partners