The impact of huge economic bailout packages, especially in the US, will steer the important investment themes of 2021.

During this past holiday season, I read through the financial reports of most of the largest investment companies regarding forecasts for the new year.

I had to suppress the urge to call this column “Forecasts for 2020 – part 2”, as by the look of things, we seem to be in for more of the same. The sobering fact is that Covid-19 is still very much a part of our lives and will most likely continue to dominate headlines in 2021, and for this reason you should adjust your investment expectations accordingly. Most of the large investment companies agree on a number of opinions and forecasts, and I’d like to discuss a few of them.

Weaker dollar

The prevailing theme across all of the reports, is the opinion that the US dollar may weaken even further in 2021.

Most of them agree that they don’t expect a massive decline from current levels, but the question remains: If we do see further weakening in the value of the dollar, what should we do?

One possible solution could be to add gold or gold mining companies to your investment portfolio. Historically (and please note that past performance does not guarantee future performance), the gold price has had a strong inverse correlation with the US Dollar Index. Local gold shares may be considered, while offshore investors could consider investing in a global gold miner exchange-traded fund (ETF).

Higher inflation

Another core theme is their concern that with the amount of stimulus planned for 2021, it may lead to a rapid rise in inflation. The reason for this is obvious. An economic recovery may lead to an accelerated rise in something like energy prices (such as fuel), which in turn could cause a rise in inflation.

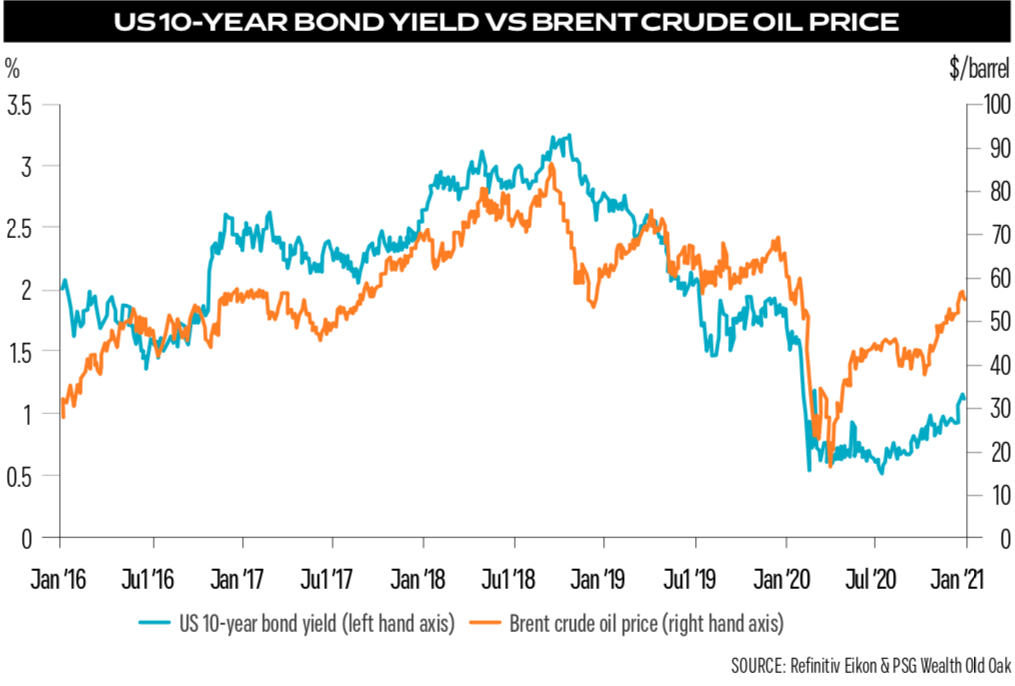

When we take a closer look at the US 10-year bond yield (see graph), a few things become clear.

One can also see a big correlation between the rates themselves and energy (Brent crude) prices.

So how do I protect my portfolio if rates were to increase, as these investment companies expect? Well, firstly make sure that you don’t hold any overweight positions in offshore bonds in your portfolio. In most cases offshore balanced funds’ mandates state that a certain portion of the fund composition must be allocated to bonds (always including US bonds).

Secondly, investors could consider adding energy exposure to their portfolios. Personally, I’m still very wary of Sasol, but local investors could consider investing in BHP to hedge against rising rates. Roughly 10% of BHP’s earnings before interest, taxes, depreciation and amortisation (ebitda) is made up of their petroleum operations.

With the Covid-19 pandemic that’s still not under control, however, I wouldn’t be in too much of a hurry to invest in the oil sector over the short term, but it can be considered in the case of further weakening. Other resources that I’m much more positive about include precious and industrial metals, which may be a better option at this stage.

Should I remain invested in shares then?

Historically, shares and a rising inflationary environment don’t get along too well. The reason is because higher inflation in most cases leads to higher interest rates, which have a negative impact on share price performance.

The US Federal Reserve, however, recently announced that right now, they are less concerned about interest rates and that they expect interest rates to remain low for the next two years.

Add to this the fact that most countries are currently announcing stimulus packages (the US recently announced a $1.9tr stimulus package, and indicated that another one is being discussed), and you can’t really afford not to have risk assets (such as shares) in your portfolio.

As the sixth-largest and one of the most liquid EMs, South Africa is positioned well enough to benefit from this. We are also one of the largest resource-driven EMs, which means that if the resources cycle improves even further, SA investors also stand to benefit.

To conclude, I need to mention that there were several other themes linked to the forecasts for 2021, and that you need to do your homework properly. Consult the experts when managing or restructuring your portfolio because if these large investment companies’ forecasts are correct, a good balance between opportunities and risk management will have to be maintained this year.

Publications

Publications

Partners

Partners