Africa’s largest mobile operator is selling assets in “volatile” markets, such as the Middle East. Now it may turn its attention more to an expanding African population and economy.

The recent announcement that MTN’s Syrian business was placed under judicial guardianship following accusations that it breached its licence conditions, is one of a string of problems Africa’s largest mobile operator is trying to put behind it through its asset sale programme and decision to leave the Middle East and focus on Africa.

MTN had already announced the pending $65m sale of its 75% stake in MTN Syria before its latest troubles there. It also plans to sell its operations in countries including Afghanistan (where it was accused of bribery and violation of the Anti-Terrorism Act in the US) and Iran (where it was charged with bribery and has been unable to extract cash due to US sanctions).

The Middle East region, once a major focus of MTN’s daring and expansive global growth strategy, contributes marginally to group revenue and profits, seemingly making it more trouble than it is worth.

MTN’s experience in several African countries has not been much easier. It has encountered numerous problems in Nigeria, including a massive $5.2bn fine, which was subsequently reduced to $1.5bn.

The group’s last few years have been focused on dousing fires in

various geographies, turning around its South African business and

acting on what it calls its asset realisation strategy, first announced

in March 2019, to reduce debt and risk. Group earnings have

gradually improved as it has tackled these issues.

Despite the positive developments, it is, for the most part, less loved by investors than its local and international competitors. Its asset realisation strategy and decision to leave the Middle East may reduce debt and risk, but debt remains high, growth opportunities are few and the pandemic has slowed its asset sales. Nigeria, a significant contributor to the group and a critical area for MTN to get right, still weighs on investors’ minds.

At this stage, MTN’s focus is less on growth than on consolidating its position and fixing the balance sheet, says Karl Gevers, portfolio manager at Benguela Global Fund Managers. “We do not think the asset realisation programme reduces growth opportunities for MTN. In our view, MTN’s growth opportunity lies with MTN Nigeria given its large investment in this region. Getting Nigeria right is critical for the group given its relative contribution (almost 40% of group earnings before interest, tax, depreciation and amortisation, or ebitda).”

Gevers says the asset realisation programme has largely been forced by its high debt levels and limited cash repatriation possibilities from Nigeria and Iran. The sale of assets “certainly reduces financial risk, a factor that has kept a lid on MTN’s rating or valuation by the market for some time now”.

Leaving the Middle East would reduce some of the geo-political risk as it has operations in volatile countries, which make up a small portion of revenue, with the Middle East, North Africa and the Iran joint venture accounting for about 11% of group revenue. “The pressure from the US in terms of allegations of MTN supporting terrorist activities would also have been a motivating factor to exit the region,” he says, adding that the group is exposed to significant forex risk, as it collects revenue in local currency and incurs a substantial amount of debt in dollars.

Gevers says he would also “not discount the weight of the pressures relating to terrorist funding allegations from the US. “The geopolitical risk and negative publicity from owning operations in the Middle East regions far outweighs the relatively small contribution toward ebitda from these regions. Effectively with the current investments in the Middle East, MTN isnot really deemed investable by US investors,” he says.

Gevers reckons the Middle East exit could result in a cash realisation of R7bn to R10bn not included in the R40bn asset realisation programme, leading to an additional improvement of the balance sheet.

Peter Takaendesa, head of equities at Mergence Investment Managers, says selling Middle East operations, which it should have done a lot earlier, would help the group reduce debt and reputational risk, and those operations “are now low return on management effort” as they contribute less than 10% of group profits.

MTN has a way to go before investors rate it positively relative to its peers. This is in some part attributable to “patchy execution as leadership changed over time,” says Takaendesa. MTN took strong leadership positions in most African countries under former CEO Phuthuma Nhleko, “but has largely been losing market share in key operating countries since”, with Airtel, Etisalat and Vodacom being its toughest competitors.

“There have been recent signs of improved execution,” he says, although that has come a bit late with regulators set to constrain MTN’s dominant market positions – it has been declared dominant in Nigeria and recently in Ghana.

Takaendesa adds that other operators have managed key stakeholder relations better than MTN, as is evident in its Nigerian fine.

This could change,

Takaendesa says, if it executes better “to, at least, avoid losing

market share, repair the balance sheet and manage stakeholders

better to avoid unnecessary fines and reputational damage”.

MTN is now increasingly betting on Africa, where the promise of a growing population and economic expansion and the reality of turnover and profitability tend to differ.

Nigeria still plays a big part in MTN’s life, says Gevers. “Nigeria has been the main reason for a lot of MTN’s pain in recent years (from regulatory issues and fines, cash repatriation to currency devaluation). The weak oil price has had a significant impact on Nigeria’s economy and ability to generate foreign reserves. This has made the repatriation of cash near impossible.” However, relations between MTN and the Nigerian government and regulators have improved, although Gevers warns there may be some testing times ahead with the upcoming license renewal in Nigeria.

There is, Gevers says, still significant growth opportunity in mobile (increasing mobile penetration), increasing data penetration and overlaying services, such as mobile financial services and digital services.

While the pandemic appears to have slowed down asset sales, some are at an advanced stage, like the R1.8bn sale of Belgacom and the Syrian operations. The most important sale to still take place, says Gevers, is the stake in IHS Towers, which delayed its listing last year.

It would be difficult for MTN to enter other geographies even if it wanted to because of the relatively high debt on the holding company balance sheet and cash repatriation challenges from Nigeria, Takaendesa says. But there is still room for significant data and mobile money growth in Africa, “although it also carries high risk from uncertain regulation as well as ongoing cash repatriation challenges in some key markets.

“We therefore believe that MTN’s target to focus on Africa is not the best outcome for investors but is better than having to deal with both Africa and Middle East headaches. Once the balance sheet has been repaired, we believe MTN needs to find growth opportunities that would reduce its large exposure to Nigeria but entering new relatively low-risk markets or consolidating in existing countries.”

Takaendesa says the core MTN business in Africa is quite profitable and growing in double digits after currency adjustment. “MTN had a first mover advantage in most markets and gained significant scale to become a top-2 operator in all its key operating countries” and scale is important for profitability for telecoms business models. He says there is still room for significant growth in mobile data and mobile money revenue in its key markets outside SA.

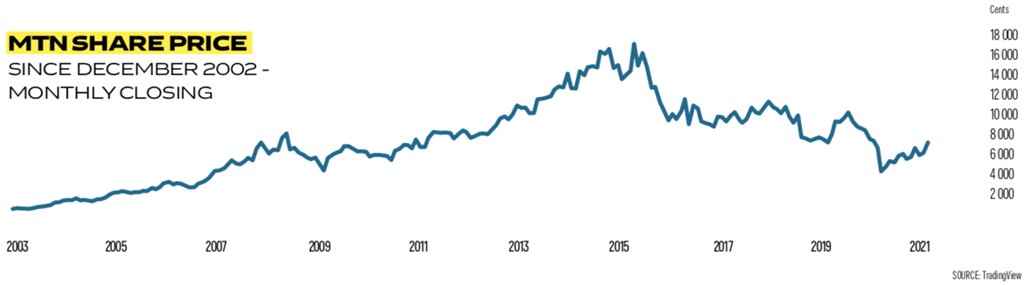

While the share is cheap, it is not necessarily a buy. “It is always very difficult to value MTN, due to very high forecasting risk and unpredictable non-operational risks, such as regulatory fines,” Takaendesa says. “The shares look cheap for a mid- to long-term investment view, especially if one believes the non-operational risks in Nigeria are in the rear view mirror and the asset realisation programme will be concluded at fair market values.”

On the surface the share may look cheap – on a forward price-

to-earnings ratio of less than eight times, and a dividend yield of

about 6.5%, says Gevers. “However, the high debt levels, regulatory

risks, currency and cash repatriation risks would increase the

required return by shareholders.” Risks in many countries in which

it operates are high and the capex requirement to maintain the

network is also significant, impacting returns, Gevers says.

“Having said that, MTN does look relatively attractive, especially with the focus on improving the balance sheet, as well as the regulatory compliance and relations in the operating regions.”

Publications

Publications

Partners

Partners