- SA's R500 billion Gold and Foreign Exchange Contingency Reserve Account will be split into three buckets.

- National Treasury will use R100 billion in the coming fiscal year to pay down debt and then R25 billion in 2025 and 2026.

- Economists have said using the reserves is a short-term patch and that austerity measures are key for future growth.

- For more financial news, go to the News24 Business front page.

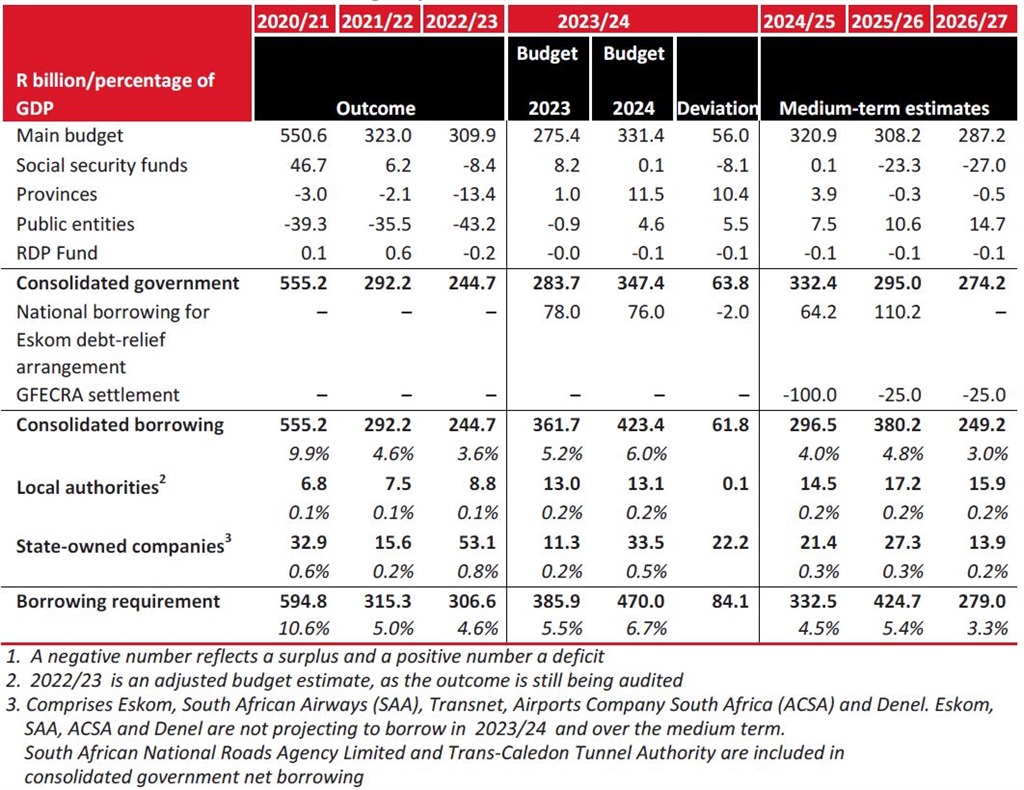

The SA Reserve Bank will distribute R150 billion of its R500-billion Gold and Foreign Exchange Contingency Reserve Account (GFECRA) to National Treasury over the next three years to reduce the country’s borrowing requirements and debt-service costs, according to the Budget.

To do this, there will be changes to how GFECRA is governed. A proposed settlement will be formalised between National Treasury and the central bank to "establish a new framework", Treasury said in its Budget documents. Once this is done, government will receive distributions of R100 billion in 2024/25, R25 billion in 2025/26 and R25 billion in 2026/27 from the Reserve Bank.

GFECRA is an account held at the Reserve Bank. It captures losses and profits on foreign currency reserve transactions, protecting the Reserve Bank from currency volatility. When the rand exchange rate against the dollar and other reserve currencies strengthens, the account balance declines; when the rand depreciates, the balance improves.

Source: National TreasuryBy tapping the GFECRA funds, government removes the need to significantly slash its spending or raise the tax burden. From a political vantage point, using this vehicle in an election year is "delightfully serendipitous," according to Professor Andre Roux, an economist at Stellenbosch Business School.

"It might also, however, be opportunistic and risky. If, in future, losses are incurred on this account, Treasury would be held liable. Furthermore, by using these contingency reserves, the country’s level of foreign exchange reserves may drop to levels too low to serve as a meaningful buffer against sudden and significant currency shocks," Roux added.

GFECRA to be split between three buckets

To try to mitigate risks National Treasury said the new framework, its planning will be split into three buckets. The first GFECRA bucket will hang on to sufficient funds to absorb exchange rate swings. Once that’s done, funds will be distributed to the second bucket, which will be a Reserve Bank contingency reserve, to ensure the central bank’s solvency and to pay sterilisation costs to neutralise the interest rate impact. Once the first two obligations have been settled, funds will be distributed to National Treasury.

In a recent interview with the UK’s Financial Times, Reserve Bank Governor Lesetja Kganyago said it was important to maintain the central bank's independence in any GFECRA transfers. He also outlined challenges in profiting from GFECRA and warned against excessive money injection.

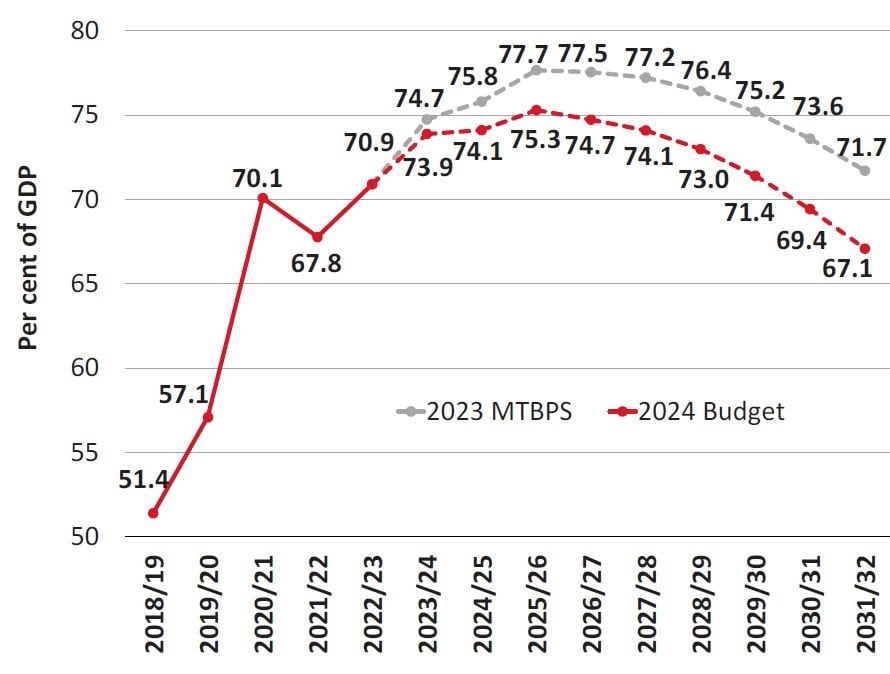

Despite the risks and the difficulties in drafting a new framework, the benefits of using almost one third of the country’s GFECRA as a quick economic fix has proven irresistible for government. Instead of SA’s debt to gross domestic product ratio rising inexorably closer to 80%, the trajectory has fundamentally changed.

Source: National Treasury

In November, Treasury said it expected the ratio to peak at 77.7% in 2025/26 and thanks to a slew of mostly negative economic data since then, economists have recently been pegging that number at closer to 80% and above. Now Treasury sees the peak at 75.3%. The new figure is dressed up to look like part of what would be considered fiscal consolidation, which is what ratings agencies want to see when weighing SA’s status.

Reducing the country’s borrowing requirements will have other positive effects in the short term. The cost of servicing debt will be reduced. The cost of selling SA government bonds could become cheaper. While yields may tighten, SA’s temporarily improved fiscal outlook may help lure foreign debt buyers, who had been tapering off steeply, and take the pressure off local institutions to buy government paper.

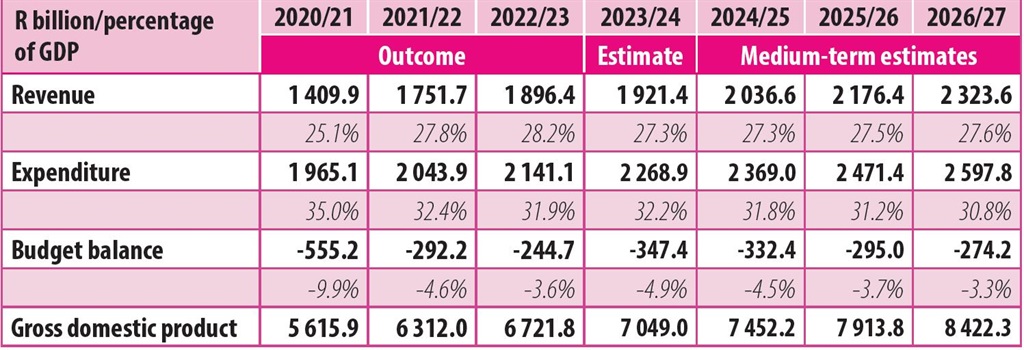

Buoyed by the boost from GFECRA, and expectations that problems at Eskom and Transnet will start to dissipate, Treasury was confident enough to make some positive forecasts for economic performance. It saw GDP in 2024 at 1.3%, up from the 1% it expected just over three months ago. Although it did have to cut the 2023 estimate for the third time, now forecasting just 0.6%, down from 0.8% in November and 0.9% a year ago.

It expected revenue to climb every year for the next three while expenditure was seen barely growing and becoming ever less of a percentage of the country’s GDP.

What happens when the GFECRA handouts end in 2027/28 isn’t clear. As Annabel Bishop, chief economist at Investec, pointed out, the account can’t be quickly replenished and it’s a temporary measure in a weak economy that has R5.2 trillion of debt. The R150 billion that Treasury will receive pales by any sort of comparison to that number.

And while Treasury is optimistic about GDP growth into the future, the past tells a different story. GDP growth has averaged 0.8% since 2012 and with unemployment high and climbing, inflation hard to tame, interest rates at a 14-year peak, expanding bad debt levels and Eskom and Transnet’s poor service delivery far from over, it’s hard to see how SA will escape the sluggishness of the last decade.

Little sign of what was promised in November

What economists wanted to hear were plans to increase taxes and cut spending, according to Professor Waldo Krugell from the North-West University. They were looking for cost-cutting measures that included a major review of budgets and spending. It would have meant closing programmes, consolidating government departments and cutting the state’s headcount, he said.

That’s what Finance Minister Enoch Godongwana and his colleagues in National Treasury intimated would happen when they spoke in November.

Instead, GFECRA.

It may help to reduce government’s debt burden, Momentum Investments said, but it

doesn’t resolve SA’s structural fiscal challenges, which depend on the implementation of key reforms to generate faster and more sustainable economic growth."

Publications

Publications

Partners

Partners