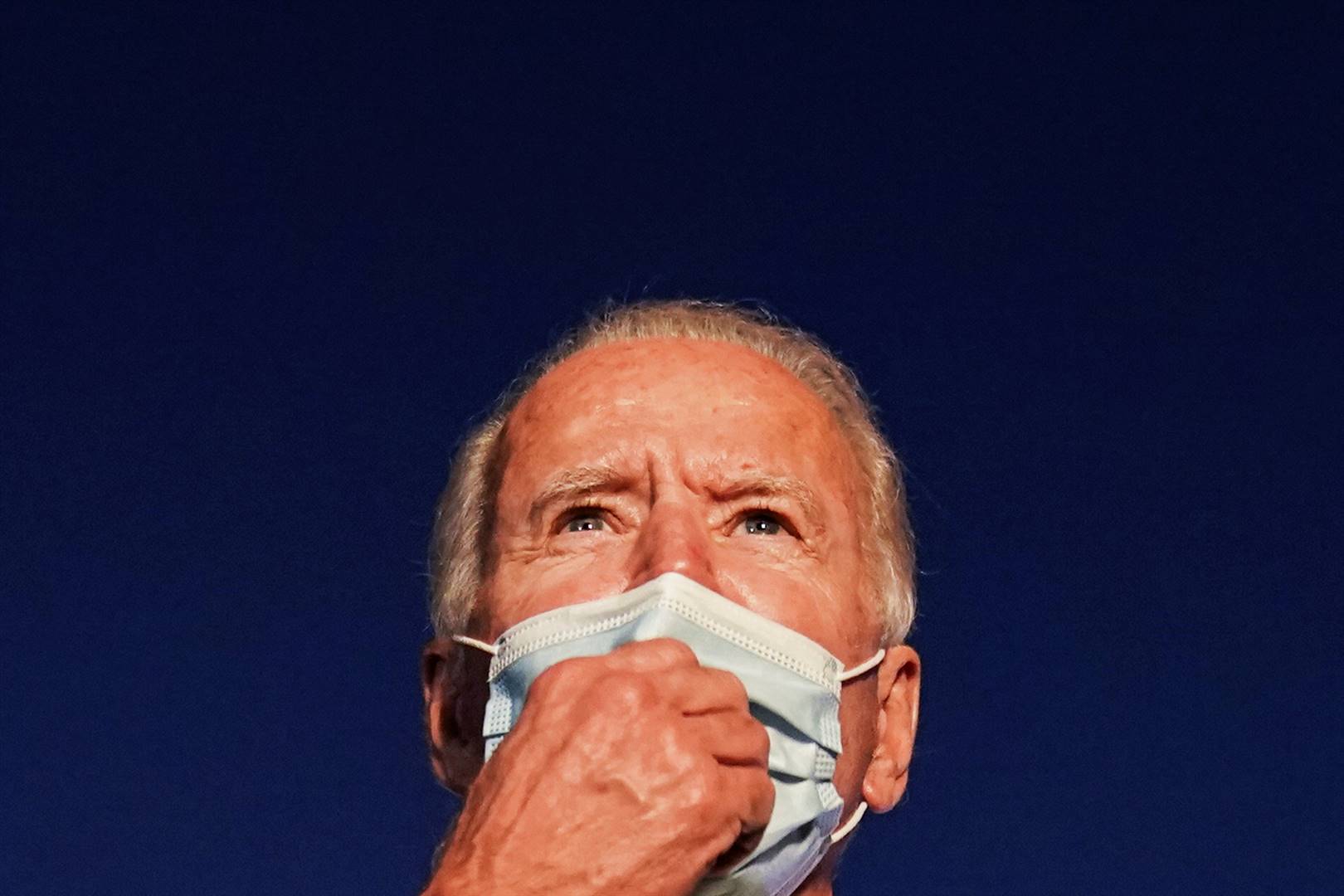

- Investors are confident Democrat Joe Biden will win the US presidency, as well as a stimulus package to follow elections.

- Markets are pricing in a Biden victory and democrats taking the Senate and House.

- Post Brexit trade talks this week continue to play on market nerves.

Stock markets mostly rose Thursday, with investors increasingly confident Joe Biden and the Democratic Party will win the US presidency and both houses of Congress, paving the way for a huge new stimulus package, analysts said.

President Donald Trump's decision to break off talks for a second rescue package gave global traders a massive jolt this week, but his call soon after for targeted help - including $1 200 handouts for Americans and help for small businesses - lifted hopes for some sort of deal.

"The market realises that whoever wins (the election), more than likely Biden now, there is going to be significant stimulus and additional infrastructure spending," said Andy Brenner, head of international fixed income at National Alliance.

The odds on a Biden win are shortening, with opinion polls putting him well ahead nationally and enjoying leads in battleground states such as Florida, where polling website FiveThirtyEight says Trump is losing the crucial senior vote.

A Biden victory and Democrats taking the Senate and House is also being priced into markets, observers said, as traders grow increasingly optimistic for a bigger rescue plan than what was being discussed before talks were curtailed Tuesday.

Democrats had initially proposed a stimulus of more than $3 trillion before lowering it earlier this year.

All three major Wall Street indexes ended with gains of close to 2% Wednesday, with Asia and Europe picking up the baton Thursday.

Post Brexit trade talks this week continue to play on market nerves, with EU Council president Charles Michel saying the bloc was keen for a trade deal, "but not at any cost".

UK Prime Minister Boris Johnson has reaffirmed London's desire for an agreement but being prepared to walk away if none was reached by October 15.

Fears the two will not reach a trade deal by next week's summit are weighing on the pound and worrying markets, with many observers warning it would be economically devastating for Britain as it battles to recover from the coronavirus.

London - FTSE 100: UP 0.5% at 5 977.01 points

Frankfurt - DAX 30: UP 0.7% at 13 017.46

Paris - CAC 40: UP 0.5% at 4 908.48

EURO STOXX 50: UP 0.6% at 3 252.39

Tokyo - Nikkei 225: UP 1% at 23 647.07 (close)

Hong Kong - Hang Seng: DOWN 0.2% at 24 193.35 (close)

Shanghai - Composite: Closed for a holiday

New York - Dow Jones: UP 1.9% to 28 303.46 (close)

Euro/dollar: UP at $1.1767 from $1.1765 at 21:00 GMT

Pound/dollar: UP at $1.2921 from $1.2913

Dollar/yen: UP at 105.99 yen from 105.96 yen

Euro/pound: DOWN at 91.03 pence from 91.04 pence

West Texas Intermediate: UP 1.4% at $40.50 per barrel

Brent North Sea crude: UP 1.6 percent at $42.65 per barrel

Publications

Publications

Partners

Partners