- Returns from different multi-asset funds are expected to vary widely in future.

- These returns have been in a narrow range.

- But managers are taking different views on their exposure to offshore equity, to credit and to private equity.

- For more financial stories, go to the News24 Business front page.

South African investors and retirement savers who are invested in multi-asset funds should expect the returns delivered by different managers to vary widely in future.

The narrow range of returns from different managers over three- and five-year periods will increase greatly as managers take different views on their exposure to offshore equity, to credit and to private equity, Victoria Reuvers, the managing director of Morningstar Investment Managers, said at the recent Investment Forum held in Cape Town and Johannesburg.

There is already more than 13 percentage points between the annual average returns of the top-performing high-equity multi-asset fund (17.1% a year) and the worst performer (3.64% a year) over the three years to the end of January, Morningstar’s data shows.

Over five years, the difference is around eight percentage points a year. The top-performing fund returned 13.36 % a year and the worst performer just 4.39% a year on average for the past five years.

At the Investment Forum, Reuvers discussed the different investment approaches of the managers of high equity multi-asset funds from Coronation, M&G, Prescient and PSG.

The Prescient and M&G Balanced Funds, for example, have a set or strategic asset allocation to the different asset classes. This can be varied with tactical asset allocation decisions to take advantage of the mispricing of shares, bonds or other securities.

Coronation and PSG use the valuations of shares, bond or other securities to decide what to include in their funds and this determines their bottom-up allocation to the different asset classes.

The Prescient fund uses passively managed index funds for its asset classes, while the other three funds are actively managed.

Offshore allocations

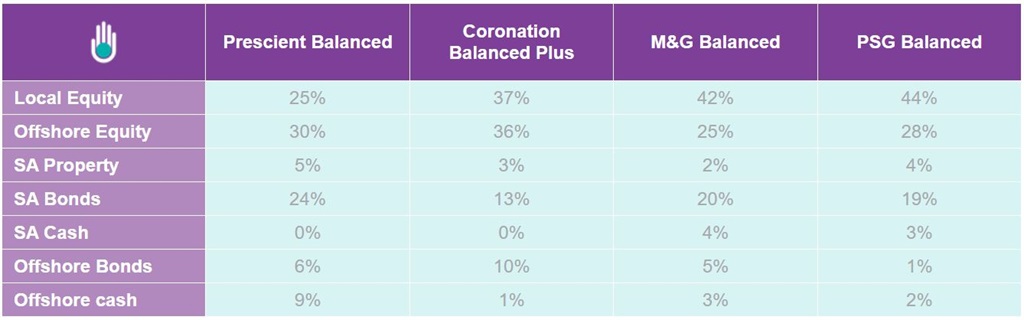

High equity multi-asset funds are allowed to have up to 75% of the fund in equities and those that comply with regulation 28 of the Pension Funds Act and are suitable for retirement fund investors, must not exceed 45% of the fund in offshore markets.

The level to which managers have been maximising the offshore allocation that was increased in 2022 is likely to play an increasing role in differences in fund returns in the future.

Reuvers said the Prescient Balanced Fund had the lowest exposure to South African equities (25%) compared to 37% in the Coronation Balanced Plus, 42% in the M&G Balanced Fund and 44% in the PSG Balanced Fund.

Bastian Teichgreeber, the chief investment officer of Prescient Investment Management, said Prescient’s low allocation to local shares had nothing to do with negativity about South Africa and more to do with diversifying away from a bias most investors have towards home-based assets.

He says 25% in the very small and concentrated South African equity market is already a "home bias on steroids". Prescient therefore has 30% in offshore equities.

The Coronation Balanced Plus Fund has 37% in the South African share market and 36% in the global equity market. Charles de Kock, a portfolio manager at Coronation, said good returns have taken the fund’s offshore exposure through foreign equities, bonds and cash over the 45% limit. The fund will rebalance back to the limits over time.

De Kock says the bulk of the fund’s local equity exposure is in global businesses that just happen to be listed in South Africa, so this means the fund has a far higher global bias than the numbers indicate.

More local equity

The PSG Balanced Fund with 44% in local equities is smaller than the Coronation or M&G funds.

Justin Floor, the fund’s manager, says the fund is small enough to invest meaningfully in about 100 to 150 local companies, making it possible to invest in some exciting opportunities that larger managers cannot invest in as their holdings in any company’s shares are restricted.

Sandile Malinga, the manager of the M&G fund with the second highest exposure to South African equity out of the four managers, says one of the key drivers of returns are valuations, and local equities are cheap relative to global equities. They have been disappointing as global markets have delivered double-digit returns, but they remain good companies and are very competently managed.

While economic growth is low in South Africa, stock markets are not driven by economic factors alone, he said. In Germany, the equity market has almost decoupled from the economy of that country, Malinga said.

Use of the AI investment theme The four managers have different views on how artificial intelligence (AI) will affect investments in future. De Kock said AI is a very important new development and not just a fad. But with investors’ money being rushed into AI-related investments, there will be winners and losers, so it is best for managers to diversify across these securities.

He warned against getting sucked into buying something on a "crazy" high valuation, as it would end in tears or losses.

Tiechgreeber says it is impossible to know which companies will be winners and which ones the losers, so it is best to own them all through an index. In such a diversified portfolio, the underperformance of the losers won’t hurt, he said.

Malinga says AI has transformed the way active managers view the world as they can analyse billions of pieces of data to inform their investment decisions.

Floor said PSG can’t predict the outcome of technological change so it prefers to focus on things that do not change – in 10 years’ time people will still be drinking beer, for example, so it is easier to invest in a beer company at a reasonable valuation.

Alternative assets

The four balanced fund managers also have very different views on exposure to alternative asset classes including unlisted private equity, credit (listed or unlisted) and infrastructure investments.

The exposure to these asset classes is not always reported separately on fund fact sheets – private equity may be bundled with equity exposure, private credit as bond exposure and infrastructure may be included as either bond or equity exposure, depending on how the fund is invested in it.

Regulation 28-compliant multi-asset funds can have up to 45% of the fund exposed to infrastructure projects, but funds are taking different views on how much of this allocation to use, if any.

Teichgreeber says the Prescient Balanced fund uses a lot of alternatives to diversify the fund. The fund has 15% in alternatives with 5% in the manager’s South African high-linked yield credit, 5% in renewable energy investments and 5% in hedge funds.

Alternative assets often trade infrequently making them illiquid or difficult to convert to cash, but Teichgreeber says the fund has 4 000 names in its equity portfolio and is therefore highly liquid.

De Kock says while private equity is serious assets class globally, it is difficult to find good players in South Africa and the illiquidity is a problem as most of Coronation’s investors can withdraw money within 24 hours.

Both he and Malinga said many alternative assets are only priced once a quarter or once a month, creating the illusion that a fund value is more stable when the price of the underlying investments may have changed.

Floor said the world is short of infrastructure and this creates a lot of opportunities for listed companies, like those in the construction sector that are building renewable energy plants. Managers can often access these companies at lower prices than private equity, he said.

Malinga said a lot of private equity is just small capitalisation company shares that are have high debt or borrowings.

Reuvers said the outcome of managers preferring or shunning different assets classes, and how each asset class performs, will make your choice of manager more important over time.

Read more: How do asset classes classify the things in which you can invest?

Multi-asset funds remain the most used funds in South Africa, with 49% of the almost R3.5 trillion invested in local unit trusts and other collective investment schemes being in multi-asset funds, according to the most recent statistics released by the Association for Savings and Investment South Africa (ASISA).

This article was first published on SmartAboutMoney.co.za, an initiative by the Association for Savings and Investment South Africa (ASISA).

News24 encourages freedom of speech and the expression of diverse views. The views of columnists published on News24 are therefore their own and do not necessarily represent the views of News24.

News24 cannot be held liable for any investment decisions made based on the advice given by independent financial service providers. Under the ECT Act and to the fullest extent possible under the applicable law, News24 disclaims all responsibility or liability for any damages whatsoever resulting from the use of this site in any manner.

Publications

Publications

Partners

Partners