A man named Gordon B. Hinkley wrote, “You cannot plough a field by turning it over in your mind”.

Although the context in which he meant it may differ greatly from this week’s theme, I found it to be a phrase that can be applied to so many things in the investment world.

When I look at today’s savings trends, I get the idea that too many South Africans have the tendency to want to save or to think about saving, but never actually get that far, because there always seems to be something more “important” in line.

Some even think that there is more than enough time for saving before retirement. That new bicycle, television set or fancy coat will bring you much more joy than saving, won’t it?

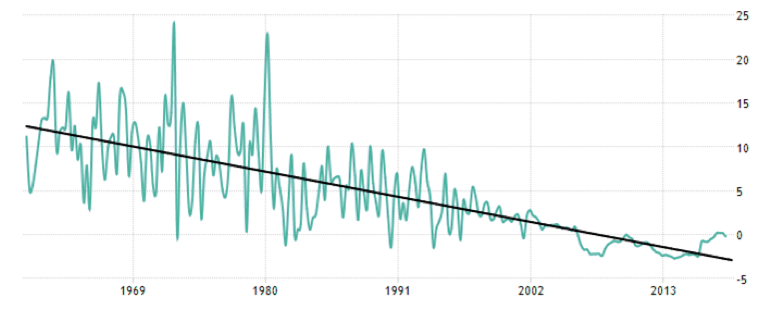

SOUTH AFRICAN HOUSEHOLD SAVINGS RATIO

SOURCE:tradingeconomics.com & STATS SA

I believe this to be the main reason why South Africa’s personal savings figures (as a percentage of personal income) have dropped from a level of around 11% in the 1970s, to around 5% in the 1990s, to its current -0.2%.

As interest rates dropped lower and lower, South Africans started to spend more and more.

Following post-recession levels of -2.7% (2013), things started to look better and we finally started to see positive figures last year.

Unfortunately, it seems as though tough economic times have taken their toll on South Africans and we now find ourselves back in the red.

A 30-year-old client once sent me an email in which he wanted to know how much he would have to save for the next 30 years in order to withdraw a retirement income of R18 000 in today’s financial terms.

There are two answers to his question – one short and one long, and we will briefly discuss both.

The short answer is quite simply to start saving today, no matter how much you save. Countless studies have shown that the earlier you start, the more comfortable your retirement will be.

The long answer will take several variables into consideration (based on government strategies and historical figures – none of which bear any guarantees for future performance).

Firstly, the government made it clear that it would like to keep inflation levels between 4% and 6%. At current risk-free return levels of 6.5%, you would therefore need to save roughly R4 320 000 in today’s financial terms at a 5% withdrawal rate to provide you with R18 000 per month.

If we assume that inflation will remain steady at 6% for the next 30 years and that risk-free returns will still trade at 6.5% at that time, it would mean that today’s R4.32 million would amount to roughly R26 million in 30 years.

If we apply an income tax rate of 30% and consider the returns delivered by all the different asset classes, it becomes clear that shares have delivered the best returns since 1986 (inflation plus 8% per year).

Property shares are currently in second place with inflation plus 5%, bonds delivered inflation plus 2% and money market underperformed inflation by -1% per year over the same period.

If the next 30 years’ average returns were to follow the last 30-year average (inflation plus), and this investor decided to invest in shares (higher risk), he would have to invest roughly R3 600 per month, escalating his contribution in line with inflation annually for the next 30 years, in order to reach his goal.

If he decided to go with a more diversified portfolio (medium risk, consisting of 60% shares, 5% property shares and 35% bonds), he would have to invest R5 250 per month (also escalating his contribution in line with inflation annually).

This may be R1 650 more per month in terms of savings, but it’s still a far cry from the R13 900 he would have to invest monthly in the money market in order to reach his goal in 30 years.

These figures are purely illustrative and based mainly on historical performance, but it clearly shows us how important it is to start saving as soon as possible.

If you won’t need to use your capital for more than 10 years or withdraw an income from it, shares still remain my investment of choice.

Schalk Louw is a portfolio manager at PSG Wealth.

This article originally appeared in the 5 July edition of finweek. Buy and download the magazine here or subscribe to our newsletter here.

Publications

Publications

Partners

Partners