Picture this scenario: Your refrigerator unexpectedly malfunctions on the 10th of the month, with your payday still two weeks away, and you haven't budgeted for a new appliance.

Alternatively, consider needing a new car but lacking the immediate funds for an outright purchase. Now, envision the relief of discovering a financier who can acquire the refrigerator or car on your behalf, allowing you to repay them through monthly rentals over a predetermined period. This concept mirrors how asset finance operates, specifically in the context of businesses acquiring the necessary equipment to thrive.

"Asset finance is the engine that drives the modern business world, providing companies with the means to acquire the equipment and resources they need to thrive. In a nutshell, it's a strategic financial solution that allows businesses to rent (or acquire), use, and benefit from valuable core business assets without the upfront burden of purchasing them outright," says Martin Scheepers, sales director of Centrafin.

How it works:

Asset finance is a versatile and adaptable tool that caters to a wide array of industries and assets, from manufacturing machinery to office equipment, vehicles, and even mining equipment. Here's how it works in a nutshell:

- Selecting the asset: The first step is identifying the asset your business needs. This could be anything from a fleet of vehicles for a transportation company to high-tech machinery for a manufacturing facility. Some financiers like Centrafin also finance niche and used equipment, which is something the larger institutions tend to avoid.

- Select the finance provider: Once the asset is chosen, you connect with an asset finance provider. These can be banks, second-tier funders like Centrafin, or other financial institutions. Click here to read more about second-tier funders, and how they play a strategic role in South Africa’s business landscape.

- Agreeing on terms: You and the finance provider agree on the terms of the financing arrangement. This includes the duration of the contract, the monthly payment and any deposit required.

- Regular payments: You make regular payments to the finance provider, often on a monthly basis. These payments cover the cost of using the asset, including principal cost and interest.

- End-of-term options: At the end of the financing term, you usually have several options:

- Renew the rental agreement and therefore extend the rental period.

- Return the asset if it's no longer needed.

- Upgrade to a newer asset.

Asset finance offers several benefits for businesses, including:

- Preservation of capital: By spreading the cost over time, asset finance allows businesses to preserve their working capital for other essential needs, such as expansion or emergencies.

- Tax efficiency: In many cases, rental payments are tax-deductible, providing financial advantages. Johan Fourie, Centrafin’s COO, elaborates a bit on this benefit: “When you finance an asset, especially through an operating lease, the cool part is that you can deduct your entire lease payment from your taxable income. This not only saves you some cash by cutting down the income tax you have to pay, but also keeps things in check by matching up your income with the expenses that come with it.”

- Flexibility: It's a flexible solution, with options for various asset types and financing structures.

- Up-to-date technology: For technology-intensive industries, asset finance enables regular upgrades to stay competitive, but without the burden of purchasing the latest equipment outright. This allows your business to stay abreast of technological advancements, maintaining relevance while keeping your working capital in good shape.

In a nutshell, asset finance enables businesses to acquire the tools and equipment they need to thrive and grow, while maintaining financial agility. It's a cornerstone of modern business strategy, unlocking opportunities for companies of all sizes and industries.

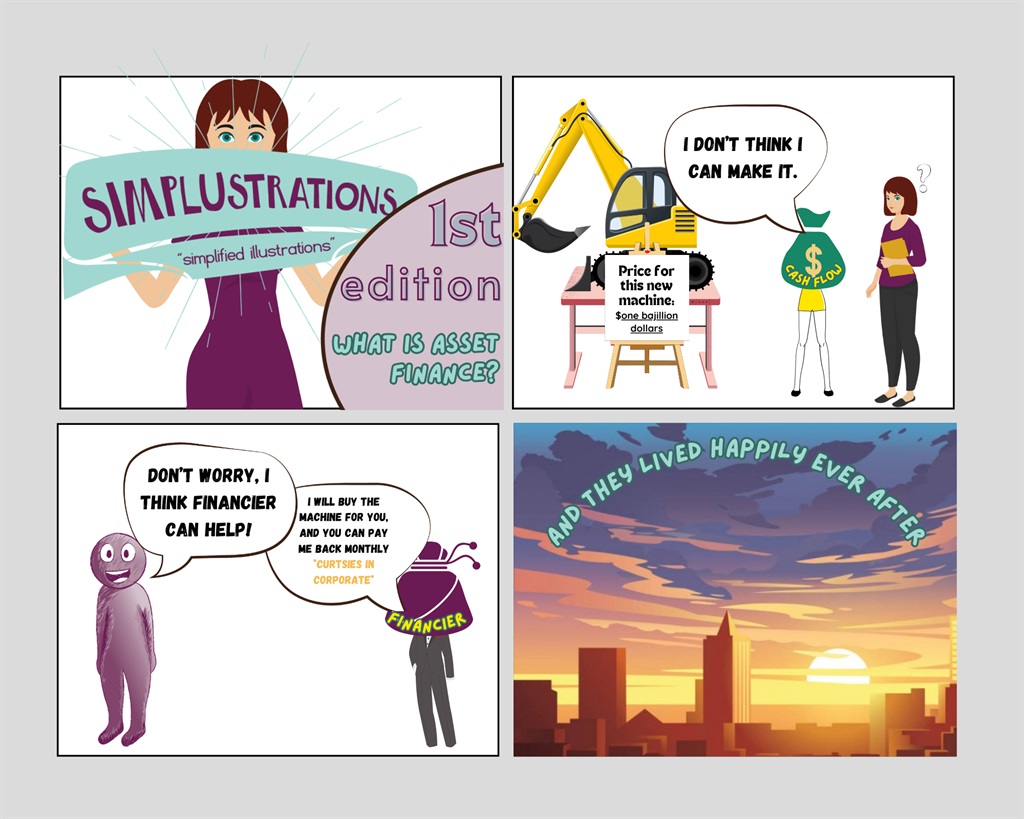

In its role as an asset financier, Centrafin has recognized a general need for widespread education on asset finance and financial literacy. To address this, Centrafin is introducing Simplustrations: simplified illustrations designed to clarify asset finance concepts and enhance financial literacy. These materials are crafted to be easily understandable and digestible for a broader audience.

Stay connected with Centrafin’s Simplustrations page by following @simplustrations (also known as CentrafinExplains) on Instagram for a weekly dose of comic skits. Dive into the world of asset finance and financial literacy, explained in a delightful and entertaining manner.

Centrafin will share their Simplustrations comic skits on their Facebook and LinkedIn pages, in addition to featuring them on their website.

This post and content is sponsored, written and produced by Centrafin.

Publications

Publications

Partners

Partners